Community outreach: Industrial Bank gives free financial literacy programs yearly and participates in group service. Any sum of money saved will add up after constant saving over a couple of months or a year. Not solely will you be saving more for your house, however you’ll be getting used to the additional expenditure that can come with it. One of many interesting things about saving for retirement through a traditional 401(ok) plan is that you’re stashing away pretax dollars. Some folks hedge their bets by splitting their retirement money between the 2 choices. But when you are like most people you most likely spend it. Fact: Many people spend greater than we should on things like insurance coverage, cable, phone service, and utilities. Not the half where Americans owe billions of dollars in schooling loans — that does not appear to have modified a lot — however the array of choices available for making use of, repaying and consolidating federally assured student loans right now seems not solely extra flexible, but in addition useful and helpful.

Community outreach: Industrial Bank gives free financial literacy programs yearly and participates in group service. Any sum of money saved will add up after constant saving over a couple of months or a year. Not solely will you be saving more for your house, however you’ll be getting used to the additional expenditure that can come with it. One of many interesting things about saving for retirement through a traditional 401(ok) plan is that you’re stashing away pretax dollars. Some folks hedge their bets by splitting their retirement money between the 2 choices. But when you are like most people you most likely spend it. Fact: Many people spend greater than we should on things like insurance coverage, cable, phone service, and utilities. Not the half where Americans owe billions of dollars in schooling loans — that does not appear to have modified a lot — however the array of choices available for making use of, repaying and consolidating federally assured student loans right now seems not solely extra flexible, but in addition useful and helpful.

You probably have both private and federal education loans and are contemplating consolidating them right into a single personal loan, borrower beware: For probably the most part, federal loan packages supply charges and benefits that personal lenders just can’t beat. Although it may appear daunting, it’s good to read any plan you are contemplating very rigorously so you know precisely what’s covered and the way a lot you are going to spend, not just in premiums, but in deductibles, co-pays and different out-of-pocket bills. You need to point out why you’ll be able to now not afford your monthly payment, such as in case you had an ARM that’s readjusted at a rate you can’t afford. You possibly can roll it over into a Roth IRA with out paying taxes. It combines features from each the standard 401(ok) and the Roth particular person retirement account (IRA). After all, this may be fairly perilous down the highway in the event that they find yourself with little or no retirement financial savings at age 62. Some firms choose to nudge their workers toward sensible retirement planning by mechanically enrolling them in a 401(okay) plan. Loan consolidation can assist you to decrease your monthly funds, might assist you defer or prevent from defaulting on your mortgage, and will provide you with more time to repay (as a lot as 30 years).

Or, it’s possible you’ll find yourself racking up student loan debt when you may have received scholarships, grants or work-study funds had you been extra ardent in seeing your FAFSA by. While it should be a little tempting to forestall investment at that time, you have got to keep in mind that usually, extra money is formed at the lowest of the market than at the highest. While the typical foreclosure sells at greater than 25 % under the listing value, needless to say this represents an average across the complete nation. The common American faculty graduate with scholar mortgage debts owes more than $22,seven hundred — and two out of every three graduates leaves college with not solely a diploma, but with schooling debts. These usually present you need 1,000,000 or extra dollars to retire with your current lifestyle. That method, you may make sure that you’re getting the proper deal and that you’re not paying greater than you need to. Most lenders have a minimum requirement of 20% to 30%. You may make the minimum cost or in case you have excess funds available, you can also make a better down cost. Options embrace private consolidation loans, of which most will have a variable interest charge in addition to variable minimum and maximum loan limits, fees and rules.

And the Finance Committee within the Kuwaiti National Assembly had previously approved, on December 15, the state’s purchase of citizens’ debts related to shopper and private loans, and the deduction of a cost-of-dwelling allowance of one hundred twenty dinars until the end of the mortgage, and that becoming a member of the law be non-obligatory for many who wish to do so, in addition to approval To recover unlawful curiosity on citizens’ loans that had been decided upon by way of rulings issued by the Kuwaiti judiciary, and to raise the minimum pension and increase it for segments whose salaries vary from one thousand to 1,500 dinars. Peggy Post, the daughter-in-regulation who took over Emily Post’s etiquette empire, says it originated within the Netherlands throughout the 18th century. Of course, who can predict what their tax fee can be in the future, particularly if retirement is many years away? Personally for me, even when the fraudulent cost is a few measly $5 charge, if I can dispute it in a painless and non-time-losing manner, then I’m one happier camper. If you are an expert in your discipline, then a profession in enterprise consulting would be the one for you.

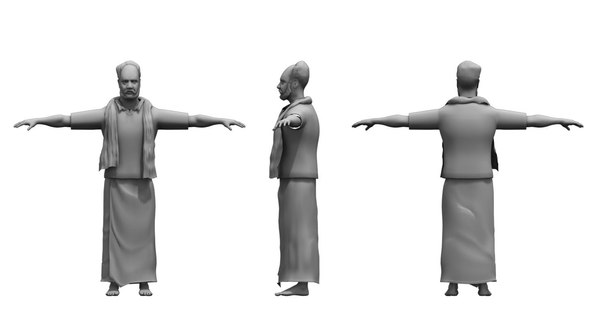

If you liked this posting and you would like to receive a lot more info about midjourney ai kindly take a look at our own page.